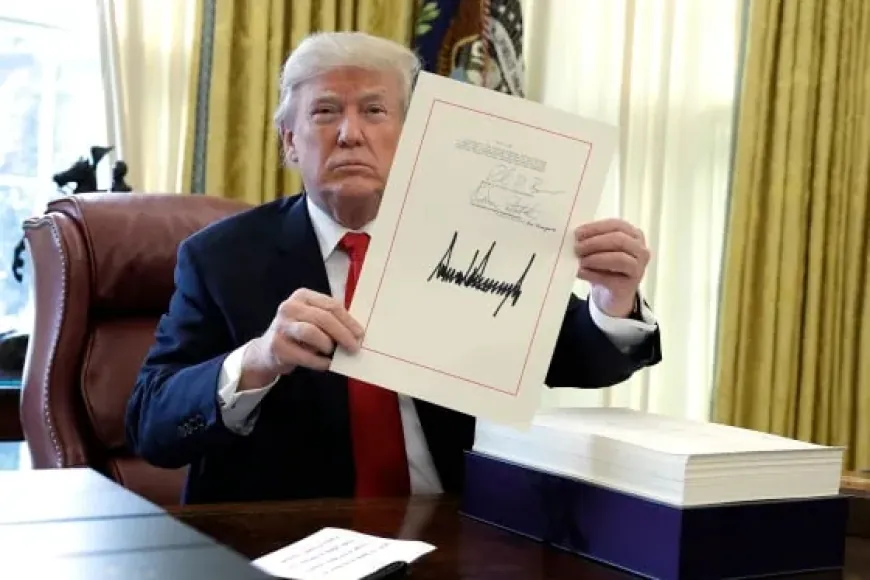

WASHINGTON — Starting in 2026, millions of U.S. taxpayers will owe less to the IRS. The change comes after President Donald Trump signed the One Big Beautiful Bill Act into law on July 4. The sweeping tax legislation locks in much of the 2017 Tax Cuts and Jobs Act while introducing several new provisions aimed at reducing taxable income for workers and households across all income levels.

An analysis by the Tax Policy Center, a nonpartisan policy group based in Washington, finds that the average tax cut in 2026 will be about $2,900 per household. But that average masks wide differences. Higher earners are positioned to receive the largest savings in absolute dollar terms and as a share of federal tax liability.

Who Saves How Much?

The new tax law impacts every income bracket, but the benefits are not evenly distributed. Here’s the full breakdown of estimated savings in 2026:

| Income Group | Annual Income Range | Average Tax Savings |

|---|---|---|

| Top 0.1% | $5,184,900 and above | $286,440 |

| Top 1% | $1,149,000 and above | $75,410 |

| Top 20% | $217,101 and above | $12,540 |

| Fourth Quintile | $119,201 – $217,100 | $3,460 |

| Middle Quintile | $66,801 – $119,200 | $1,780 |

| Second Quintile | $34,601 – $66,800 | $750 |

| Bottom 20% | $0 – $34,600 | $150 |

Source: Tax Policy Center, July 2025

Overtime and Tip Income Becomes Tax-Free

One of the most significant changes in the new law is the removal of federal income tax on overtime pay and tipped wages. This provision applies to workers who properly report their extra earnings.

For service industry employees, this change could mean thousands of dollars in additional take-home pay annually. For example, a restaurant server earning $25,000 in base pay plus $10,000 in reported tips will no longer pay federal income tax on that $10,000. Similarly, warehouse and manufacturing workers regularly working overtime will see their tax bills drop due to the exclusion of overtime earnings from federal taxation.

This move is expected to cut IRS enforcement costs associated with tracking tipped income while providing a direct financial benefit to hourly workers and employees in hospitality, retail, and logistics sectors.

SALT Deduction Cap Raised to $40,000

The new law raises the cap on state and local tax (SALT) deductions from $10,000 to $40,000. This change reverses one of the most contentious provisions of the 2017 tax code overhaul.

Taxpayers in states with high property and income taxes—such as New York, New Jersey, California, Connecticut, and Illinois—stand to benefit the most. In these states, the previous SALT cap forced many upper-middle-class households to pay federal taxes on income already taxed heavily at the state and local level.

Raising the SALT cap to $40,000 restores a tax break that had been sharply limited for seven years. For homeowners in high-tax counties, the deduction can now offset more of their property taxes and state income taxes, resulting in lower federal tax bills.

Tax Cuts Extended Beyond 2025

Several tax provisions from the 2017 law were set to expire at the end of this year. The One Big Beautiful Bill Act extends them, keeping personal income tax rates lower than pre-2017 levels.

-

The standard deduction remains doubled, allowing individuals to exempt a larger portion of their income from taxation.

-

The child tax credit remains expanded, although income phase-outs and eligibility limits are unchanged from current levels.

-

Marginal tax rates for individuals stay at reduced levels compared to pre-2017 rates.

Without this extension, many middle-income and upper-middle-income households would have faced automatic tax increases starting in 2026.

Top Earners Receive the Largest Dollar Savings

Households in the top 20% of income earners—those making $217,101 or more—will receive an average tax cut of $12,540 in 2026, according to the Tax Policy Center.

At the very top, the wealthiest 0.1%—those earning $5.18 million or more per year—are projected to save $286,440 on average.

While this group pays the largest share of total federal income taxes, the absolute size of their tax cuts is drawing criticism from policy analysts who argue the law will widen income inequality.

Middle-Class Households See Moderate Cuts

For the middle quintile—households earning between $66,801 and $119,200—the average tax cut will be about $1,780in 2026. This group benefits from the continued lower tax rates, the larger standard deduction, and the new exclusions for overtime pay and tips.

The second quintile, representing households earning $34,601 to $66,800, will receive an average tax cut of $750.

For the bottom 20% of earners—households making $34,600 or less—the average tax savings will be $150. Since these households already pay relatively little in federal income tax, their absolute savings are smaller.

IRS Withholding Changes Coming in 2026

The IRS will publish new withholding tables before the end of 2025. Employers will be required to adjust how much federal tax is deducted from workers’ paychecks starting in January 2026.

These changes mean that many employees will see slightly larger paychecks throughout the year. The first full tax returns reflecting the new law will be filed during the 2027 tax season, when taxpayers submit returns for the 2026 calendar year.

How the New Tax Law Affects the Economy and the Federal Budget

The One Big Beautiful Bill Act changes how millions of Americans pay taxes, but it also carries long-term financial consequences for the federal government. The Congressional Budget Office (CBO) projects that the new tax law will increase the national debt by $3.5 trillion over the next decade. Much of that cost comes from keeping the 2017 tax cuts in place, which were originally designed to expire in 2025 to limit their impact on the deficit.

By extending those cuts and adding new tax breaks—such as removing federal taxes on overtime and tipped income—the law reduces government revenue at a time when federal spending is at historic highs. Interest payments on existing debt are already projected to grow faster than any other federal budget item in the next five years, according to CBO estimates. The tax changes could accelerate that trend.

Who Benefits from the SALT Deduction Increase?

Raising the cap on state and local tax (SALT) deductions from $10,000 to $40,000 provides significant relief to homeowners and high-income earners in states with steep property taxes and income taxes. Households in New York, California, New Jersey, Connecticut, and Illinois are among the biggest winners from this provision. In these states, even upper-middle-class families often pay well over $10,000 a year in local taxes.

The cost of lifting the SALT cap is projected to reduce federal revenue by about $620 billion over ten years, based on calculations from the Joint Committee on Taxation. Critics argue this creates a subsidy for wealthier households in high-tax states, while others say it restores fairness by preventing double taxation on the same income.

Impact on Work Incentives and Wages

The decision to exempt overtime and tipped income from federal taxation could reshape how employees and businesses handle pay. For hourly workers, the change means extra shifts will no longer push them into higher tax brackets, potentially encouraging more overtime work. Service industry workers, particularly in restaurants, hotels, and delivery services, will keep more of their tip earnings without increasing their IRS liability.

The restaurant and hospitality sectors may also see a shift in payroll practices. By eliminating the tax on tips, the law reduces the need for cash-based tip avoidance, which has been a persistent problem in tax enforcement. The IRS has long struggled to track tip income accurately, and this provision removes much of that administrative burden.

However, labor economists caution that some employers might respond by adjusting base wages downward over time, especially in sectors where tipping is common. If workers are keeping more of their tips tax-free, businesses could reduce hourly pay to balance labor costs. This outcome will likely vary across regions and industries.

Summary of the 2026 Tax Law Changes

Here’s a clear look at what the new law does:

-

Overtime pay and tipped income will no longer be subject to federal income tax starting in 2026.

-

The SALT deduction cap is raised from $10,000 to $40,000, providing relief for households in high-tax states.

-

The 2017 tax cuts are extended beyond their original expiration, preventing automatic increases in tax rates for most income groups.

-

The largest dollar savings go to the top income earners, but taxpayers across all brackets receive some reduction in federal tax liability.

-

Employers will update IRS withholding starting in early 2026, and the first tax returns under the new law will be filed in 2027.

Also Read: Trump’s ‘Big Beautiful Bill’ Offers Tax Breaks, Adds Trade Risks

|

Follow iShook on Social Media for More Tips and Updates! |