Late-night minting, hidden permissions, precision dumping by insiders, 8.4 million tokens dumped in seconds, synchronized treasury transfers — complete on-chain evidence disclosed systematically for the first time

Over the past year, a team claiming “DAO autonomy” and “treasury-backed safety” launched three consecutive projects: AKAS, OLY, and LynkCoDAO.

Each project was promoted with the same slogans — “decentralized,” “fair and transparent,” “permissionless” — attracting large inflows of capital from domestic communities.

However, through on-chain tracking, behavioral analysis, and community interviews, this publication has found that these three schemes not only share striking similarities, but also exhibit a fully replicable structure of centralized control disguised under a pseudo-DAO facade.

Even more alarming: despite all three projects collapsing and causing severe losses, the same team has quietly begun promoting a fourth project — CryptoDAO (V3 PRO) — prompting many industry observers to ask:

“Three cuts weren’t enough — now they’re going for a fourth?”

This investigative report presents, for the first time in full media format, the key details and deeper logic behind these consecutive collapses.

Chapter One | Three Consecutive Blowups Are No Coincidence: The Systemic Structure of a Fake DAO Fully Revealed

Investigations show that AKAS, OLY, and LynkCoDAO not only use similar mechanisms but also display identical systemic risks:

- The same “treasury-backed floor price” narrative

- The same claim that “all permissions have been discarded”

- The same retained ability to mint tokens manually at any time

- The same pattern of executing critical operations late at night

- And the same ending: massive dumping and collapse

On-chain behavior shows a clear template-like logic:

Different skins, same core.

Different names, same model.

These three were not independent incidents — they were sequential harvests using the same technical structure.

Chapter Two | AKAS: Late-Night Quadruple Mint, Arbitrary Token Creation, Consecutive Dumps — The First Cut on the Entire Community

AKAS was the first station of the cycle — and the first major blow.

Promoted through slogans such as “1 USDT mints 1 token,” “treasury-backed,” and “transparent governance,” it quickly attracted a large following.

◆ Promises vs. Reality: 10 USDT Could Mint 32,000 AS?

Although officials repeatedly emphasized “1 USDT = 1 AS,” on-chain data shows:

- Multiple large mints occurring daily

- No triggering logic, no voting, no governance

- Mint volumes often in the tens of thousands

- Extreme cases reported by the community:

10 USDT → 32,000 AS

This means the promised “scarcity” and “treasury backing” never existed.

◆ Minting Behavior Highly Patterned: Mostly During Late-Night Hours

Analysis of 20 days of data reveals:

- Minting usually occurred between midnight and early morning

- Executed by the same address

- At least one mint per day, often preceding larger upcoming mints

This is classic project-team manual minting, a complete violation of DAO principles.

◆ September 21, 5 AM: Four Consecutive Mints Totaling 280,000 AS

The situation peaked on September 21:

- At 5:00 AM

- The same address

- Executed four consecutive mints

- Totaling 280,000 AS

No announcement.

No notice.

No governance.

Yet it heavily impacted the market.

◆ September 24–26: Project-Team Dumping — The First Clear Evidence of Internal Cash-Out

Starting September 24, newly minted tokens gradually entered the market, causing decline through heavy selling.

The critical moment came on September 26:

- Multiple addresses linked to the project team

- Dumped a large volume of tokens into the liquidity pool simultaneously

- Causing an instant price collapse — a cliff-drop on the chart

The synchronized behavior is nearly impossible to explain as “market activity.”

Experts stated:

“The AKAS crash was not market-driven — it was a systematic liquidation triggered by the project team.”

AKAS’s disastrous trajectory set off a chain reaction that impacted the following two projects.

Chapter Three | OLY: Permissions Revived, Tax Rates Modified Instantly — The Second Cut Targeted the ‘Leader Class’

After AKAS collapsed, the community was shaken.

But the project team did not stop — instead, they quickly pushed OLY among core leaders.

Unlike AKAS, which targeted the broader community, OLY directed its harvesting at leaders — individuals with teams, networks, and mobilization ability.

Cutting one leader meant cutting an entire group.

◆ The Project Team Fed Leaders Three Key Promises

- “This is the only chance to recover losses from AKAS.”

- “You are our core; we will give you exclusive early access and internal allocations.”

- “This time permissions are truly discarded — impossible to manipulate.”

These assurances convinced leaders to support the project again.

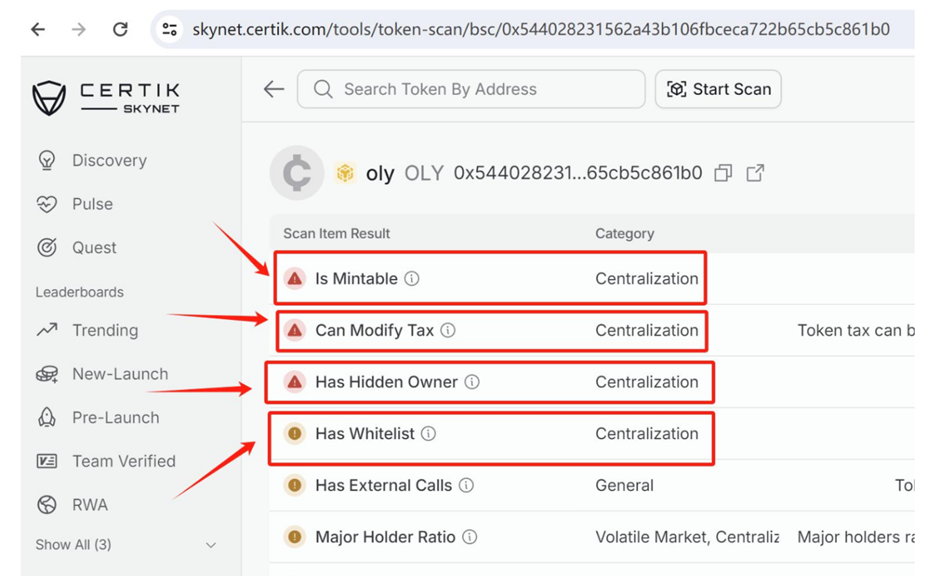

◆ Contradiction Exposed: Claimed ‘No Permissions,’ but Tax Rate Changed from 99% to 3% Instantly

After launch, a major anomaly appeared:

- Tax rate was adjusted from 99% down to 3%

- The change took effect immediately

This proved the so-called “discarded permissions” did not actually exist.

Both on-chain data and audits confirmed:

- The contract contained hidden functions

- Administrative permissions could be reactivated

- Control was never truly destroyed

Certik also flagged related risks.

◆ Leaders Became the Most Precise and Painful Targets

OLY eventually collapsed as well, with many leaders — who brought in their teams — suffering the heaviest losses.

Analysts noted:

“Leaders were harvested because they believed they held early advantages, unaware of the massive systemic backdoors.”

The second scheme targeted its victims with precision.

Chapter Four | LynkCoDAO: Six Consecutive Mints Totaling 8.4 Million Tokens — The Most Violent Collapse Occurred After Midnight

LynkCoDAO was the most aggressive and least disguised collapse of the three.

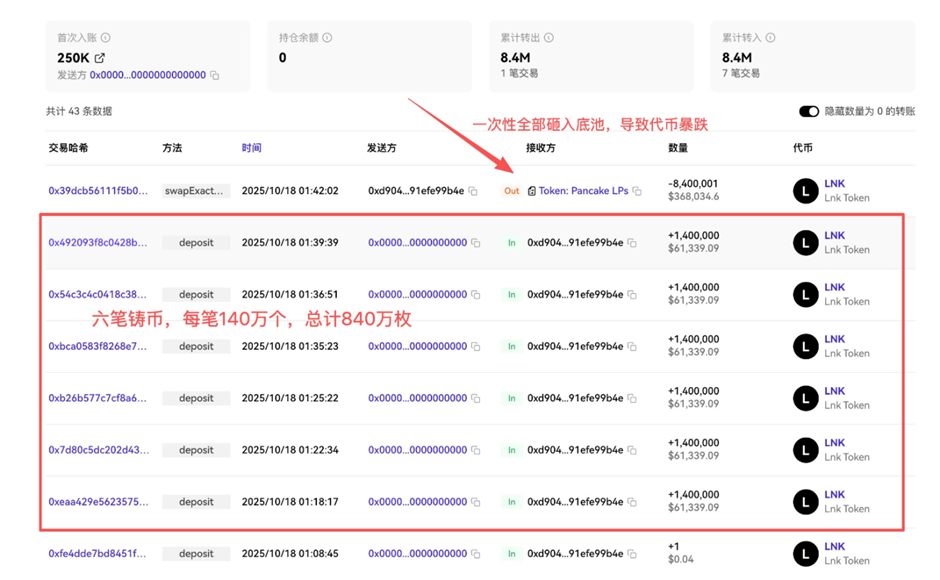

◆ October 18, 1:18 AM: Six Mints, 1.4 Million Each — Total 8.4 Million Tokens

On-chain data shows:

- Same address

- At 1:18 AM

- Within less than a minute

- Six consecutive mints

- Each mint: 1,400,000 tokens

- Total: 8,400,000 tokens

Such minting volume is extremely rare in any DAO project.

◆ Minting Followed by Immediate Dump: Price Crashed from 25 USDT to 0.04 USDT in Minutes

Right after minting:

- Enormous volumes were dumped into the pool

- Price collapsed from $25 to $0.04

- Entire process lasted under 10 minutes

By the time the community asked what had happened, the game was already over.

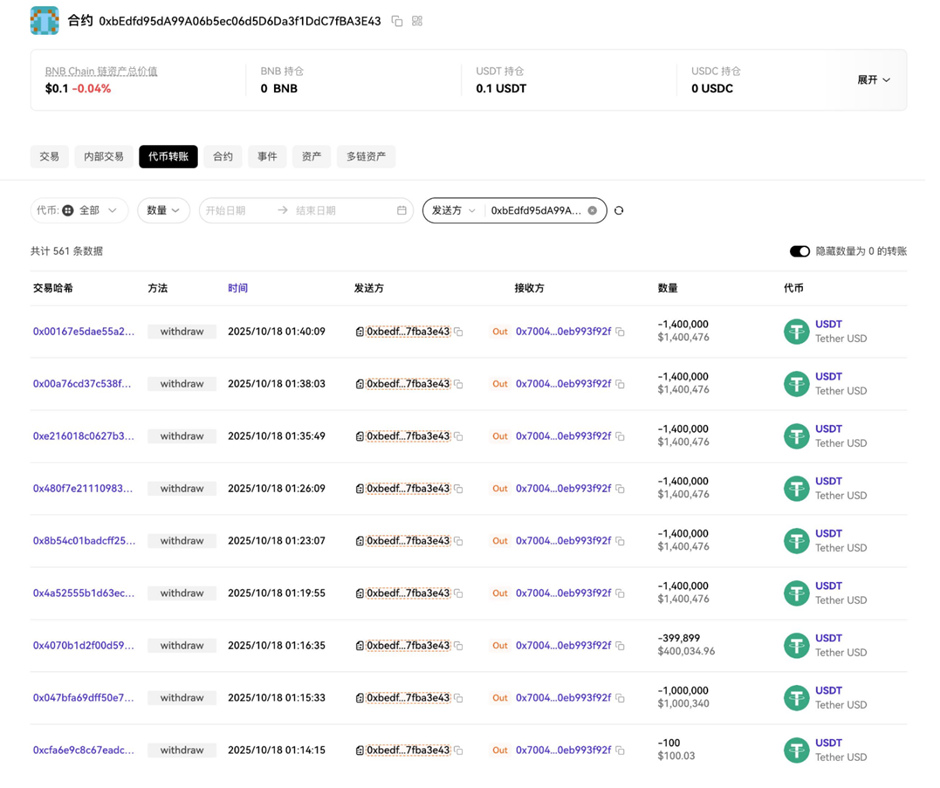

◆ Treasury Transfers Synchronized — Amounts Matched Mint Volumes

Equally alarming:

- The treasury wallet, during the same time window

- Sent out multiple large transfers

- Each transfer amount exactly matched the mint sizes

The supposedly “backing” treasury was in fact a single-signature wallet controlled by the team, movable at any time.

◆ Analysis: The Third Scheme Needed to Cash Out Fast Because the Model Was Failing

Why so crude?

Experts explained:

- Community already doubted the model

- New inflows were low

- Leaders no longer blindly trusted the team

- The scheme could not be sustained

Thus, the third scheme adopted a “lightning liquidation” strategy:

- Rapid mint

- Immediate dumping

- Fast fund extraction

A classic “final harvest.”

Chapter Five | Side-by-Side Comparison: This Is a Cyclical Harvesting System — Not Three Separate Projects

When comparing all three schemes item by item, the investigation team found:

| Key Structure | AKAS | OLY | LynkCoDAO |

| Were permissions truly discarded? | ❌NO | ❌NO | ❌NO |

| Manual minting possible? | ✔ Yes | ✔ Yes | ✔ Yes |

| Treasury control | Single-sig | Single-sig | Single-sig |

| Timing of mints | Late night | Late night | Late night |

| Final outcome | Collapse | Collapse | Collapse |

The similarities are chilling.

Experts concluded:

“These were not three accidents — they were one structured harvesting system.”

Chapter Six | Before the Blood of the First Three Schemes Dries, the Team Has Already Launched CryptoDAO (V3 PRO)

Despite the consecutive blowups of AKAS, OLY, and LynkCoDAO, the same team has already begun promoting CryptoDAO (V3 PRO).

Promotional slogans include:

- “The best encounter yet”

- “Team relationships fully on-chain”

- “RBS upgraded and open-sourced”

- “Completely decentralized this time”

- “V3 PRO architecture is entirely different”

But the problems remain:

- Have they explained the causes of the previous collapses? — No

- Has the treasury fund flow been disclosed? — No

- Why did permissions revive? — No explanation

- Why multiple late-night mints? — No explanation

Launching a new scheme without addressing any of these issues raises serious doubts about intent.

Chapter Seven | Three Hard Warnings for Investors

Experts unanimously advise:

🚫 1. Avoid any project that has not truly renounced permissions.

🚫 2. Teams that launch a new project without resolving previous failures are extremely high-risk.

🚫 3. Projects that lure “leaders” with early positions are the most dangerous.

Conclusion | CryptoDAO (V3 PRO) Is Not a New Opportunity — It Is the Continuation of the First Three Cuts

On-chain data does not lie.

Collapse patterns do not lie.

CryptoDAO (V3 PRO) is not a “new beginning.”

It looks far more like “the fourth harvesting operation.”

No level of packaging can cover up the bloodstains left on-chain.